Getting a home loan within the Asia is fairly effortless however it is an expensive fling. Although not, there was a gold liner to help you it, in fact it is the various income tax benefits one can possibly get all year inside, according to the arrangements of Tax Operate, of 1961. It Act includes individuals sections below hence other financial income tax advantages is provisioned to own financial borrowers to help you avail.

A house loan has one or two issue: payment of one’s dominating share in addition to desire costs. Thank goodness, both of these be eligible for taxation write-offs. If you are prominent cost is actually deductible significantly less than Point 80C, deduction for the attract fee is actually enjoy less than Area 24(b) of one’s Tax Work, 1961. Continue reading to know how-to take advantage of the attention for the casing mortgage deduction for ay 2023-24.

Taxation Positives on the Mortgage brokers

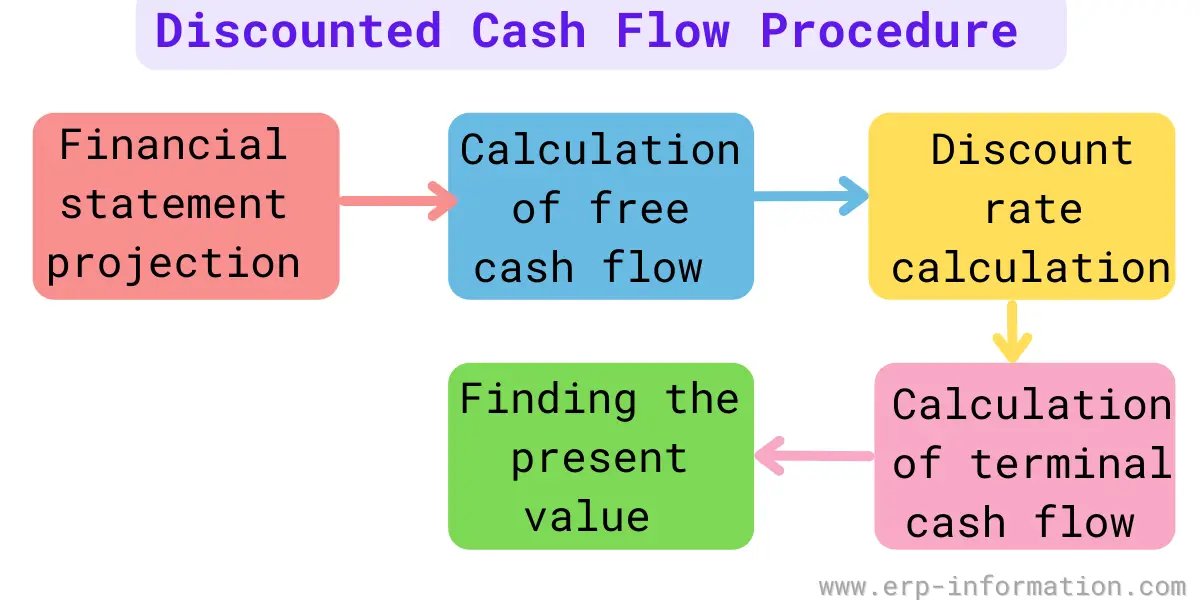

The following dining table shows new yearly taxation pros in more sections of the cash Taxation Act, off 1961, showing your house financing focus tax deduction and you may property financing focus exception to this rule.

That it financing must be approved (delivery 01.cuatro.2016 and you will ending 31.3.2017). The loan matter is actually lower than otherwise comparable to ?thirty five lakh in addition to worth of possessions will not exceed Rs. ?fifty lakh.

Part 80C: Income tax Masters to your Payment of the house Mortgage Principal Matter

A home loan debtor try permitted to allege https://paydayloanflorida.net/warrington/ taxation masters upwards so you’re able to ?1,50,000 on the dominating fee from their/their taxable earnings, each year. That it benefit will be claimed for local rental and you may worry about-filled functions.

- In order to allege benefit not as much as that it part, the house whereby the borrowed funds has been lent will be totally situated.

- Additional income tax advantage of ?step one,50,000 can claimed under it part to possess stamp obligation and membership costs; but not, it could be claimed only once, we.e., during the time of these costs incurred.

- An effective deduction claim can not be produced in the event the same house is ended up selling within this 5 years off possession.

- In this case, one claimed deduction will be reversed in the year away from sale. On the other hand, which contribution will be included in the man or woman’s money to your year, where property is marketed.

Lower than Area 24(b), a beneficial taxpayer normally claim an effective deduction with the interest repaid on our home mortgage. In this situation,

- You can claim a beneficial deduction towards appeal paid off to your domestic financing to own a personal-filled family. The maximum taxation deduction greet is perfectly up to to ?2,00,000 on the gross yearly earnings.

- But if a guy possess a couple of house, then in this case, new shared income tax allege deduction to have mortgage brokers try not to meet or exceed ?dos,00,000 inside an economic season.

- When your domestic has been leased out, then there’s zero limitation regarding how far it’s possible to allege on attract paid off. This can include the entire amount of focus reduced with the domestic financing into pick, construction/repair, and you can restoration otherwise fix.

- In the event of losings, it’s possible to allege a good deduction off just ?2,00,000 within the a monetary season, because the remaining portion of the claim is transmitted give for a tenure out of 7 many years.

Significantly less than Part 24(b), a person can plus allege an excellent deduction with the interest rate in the event your property ordered is actually significantly less than build, just like the design is carried out. So it part of the Act lets states on the one another pre-construction and you will blog post-framework several months attract.

Section 80EE: Most Write-offs to the Appeal

- This deduction will be stated as long as the expense of the fresh house gotten cannot meet or exceed ?fifty lakh additionally the amount borrowed can be ?thirty-five lacs.